Top 7 Best Radiant Capital Alternatives of 2026

Capital Alternatives for Safer Borrowing in 2026

We found the Top Best 7 Radiant Capital Alternatives of 2026. Many traders use lending platforms to unlock liquidity without selling their tokens, while long-term holders use them to earn yield on idle assets.

Many users also want a truly decentralized setup, meaning the protocol can keep running even if a single company disappears. Consequently, platforms that support governance, open audits, and robust collateral frameworks tend to win trust over time. Therefore, here are the 7 best Radiant Capital alternatives currently leading the industry.

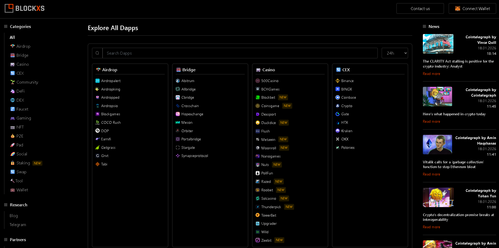

7 Best Radiant Capital Alternatives

1. Aave – The Blue-Chip Lending Standard

Aave tops our list as the most established DeFi lending option for many users. Furthermore, this battle-tested platform operates with overcollateralized borrowing and flexible rate models across multiple networks. Notably, Aave excels in deep liquidity, which often means smoother borrowing and less slippage when moving size.

What sets Aave apart is its mature risk framework. Specifically, it supports a wide range of collateral types and carefully tuned loan-to-value settings. Additionally, it has a long history of audits and large-scale usage under market stress. Moreover, its multi-chain footprint helps you choose between lower fees and higher liquidity. Consequently, with strong liquidity and proven mechanics, Aave delivers reliable DeFi borrowing and lending.

2. Compound – Simple, Transparent Money Markets

Compound tops our list as the cleanest “set-and-forget” money market for core assets. Furthermore, this well-known platform operates with algorithmic interest rates that adjust based on supply and demand. Notably, Compound excels in simplicity, making it easier for new users to understand what they earn and what they pay.

What sets Compound apart is its straightforward market design. Specifically, you supply supported tokens to earn yield and borrow against your collateral with clear parameters. Additionally, the protocol has a strong reputation for conservative listings and risk practices. Moreover, its transparency helps users verify rates and utilization in real time. Consequently, with predictable mechanics and trusted infrastructure, Compound delivers no-nonsense DeFi lending.

3. Maker – Stablecoin Borrowing with DAI

Maker tops our list as the classic choice for borrowing a stable asset without selling your crypto. Furthermore, this well-known platform operates by letting users lock collateral and mint DAI, a decentralized stablecoin used across DeFi. Notably, Maker excels in stablecoin-focused borrowing, which can be useful when you want to avoid volatility.

What sets Maker apart is its collateral-backed stablecoin model. Specifically, you manage a position with defined collateral requirements and liquidation thresholds. Additionally, the system is governed on-chain with transparent parameters and risk management updates. Moreover, DAI’s wide acceptance can make it easier to move funds across DeFi apps. Consequently, with stable borrowing and strong integration, Maker delivers a dependable alternative route to liquidity.

4. Morpho – Smarter Rates via Optimized Lending

Morpho tops our list as the best option for users who want better efficiency on top of familiar lending markets. Furthermore, this optimized platform operates by matching lenders and borrowers to improve rates while still leaning on proven liquidity sources. Notably, Morpho excels in capital efficiency, which may mean better yields for suppliers and lower costs for borrowers.

What sets Morpho apart is its rate optimization approach. Specifically, it can route positions in a way that reduces wasted interest spread. Additionally, it focuses on improving user outcomes without reinventing every core component. Moreover, its design aims to keep liquidity accessible while enhancing pricing. Consequently, with smarter matching and improved efficiency, Morpho delivers more competitive DeFi lending conditions.

5. Spark – Maker-Backed Liquidity for Borrowers

Spark tops our list as a strong pick for users who want a Maker-aligned lending experience with a modern interface. Furthermore, this DeFi lending platform operates with liquidity and risk logic connected to Maker’s ecosystem in key ways. Notably, Spark excels in stablecoin utility, especially for users who want straightforward access to borrowing and earning with major assets.

What sets Spark apart is its ecosystem linkage. Specifically, it can benefit from Maker-related liquidity dynamics and stablecoin focus. Additionally, it targets a simple experience that feels familiar to Aave-style users. Moreover, it can be a practical option for users who prioritize stable borrowing and predictable markets. Consequently, with stablecoin-friendly design and clean usability, Spark delivers a compelling lending alternative.

6. Venus – High-Utility Lending on BNB Chain

Venus tops our list as a go-to lending protocol for users who live on BNB Chain. Furthermore, this fast and accessible platform operates with low-fee borrowing and lending markets that can be easier to use for smaller positions. Notably, Venus excels in affordability, which matters when you want to adjust collateral often without paying high gas.

What sets Venus apart is its chain-native convenience. Specifically, it supports popular BNB Chain assets and can integrate well with local DeFi tools. Additionally, lower transaction costs may help with active risk management like topping up collateral. Moreover, quick confirmations can make the platform feel smoother during volatile periods. Consequently, with low fees and broad BNB Chain use, Venus delivers practical DeFi lending for everyday users.

7. Euler – Advanced Markets for Experienced Users

Euler tops our list as a more advanced choice for users who want flexible lending market structures. Furthermore, this feature-rich platform operates with tools that can support nuanced strategies for collateral and borrowing pairs. Notably, Euler excels in customization, which can appeal to power users looking for deeper control.

What sets Euler apart is its strategy-friendly design. Specifically, it can offer market configurations and mechanics that support more complex use cases. Additionally, experienced users may appreciate the extra levers for managing risk and capital. Moreover, the platform’s focus on sophistication can suit traders who actively monitor positions. Consequently, with advanced controls and flexible markets, Euler delivers a strong option for seasoned DeFi borrowers.

Radiant Capital Alternatives

DeFi lending platforms give you flexible borrowing, global access, and transparent rules that anyone can verify. Additionally, they support earning yield on idle assets while keeping you in control of your keys. Notably, this category is moving toward truly decentralized infrastructure with better risk tools and smoother multi-chain use. Consequently, as blockchain technology evolves, lending will keep getting safer, faster, and more user-friendly.

Comparison Table

| Platform | Best For | Typical User Priority |

|---|---|---|

| Aave | Deep liquidity and proven lending | Reliability and large markets |

| Compound | Simple money markets | Clarity and ease of use |

| Maker | Stablecoin borrowing (DAI) | Avoiding volatility in loans |

| Morpho | Optimized rates | Better borrowing costs or yields |

| Spark | Maker-aligned lending | Stablecoin-focused lending |

| Venus | Low-fee lending on BNB Chain | Cheaper transactions |

| Euler | Advanced lending strategies | Customization and control |

Note: “Best For” highlights the primary strength of each protocol, while “Typical User Priority” summarizes what most users value when choosing it. Actual rates, fees, and supported assets depend on the specific network and market conditions.