Top 7 Best Matrix Crypto Platforms of 2026

Matrix Crypto Platforms in 2026

Matrix Crypto Platforms are very exciting right now because traders and builders want speed, clarity, and control in one place. In simple terms, “Matrix” tools help you monitor many markets at once, automate decisions, and keep your portfolio organized without needing advanced skills. Additionally, this category matters because crypto moves fast, and missing one key signal can cost you money or a good entry.

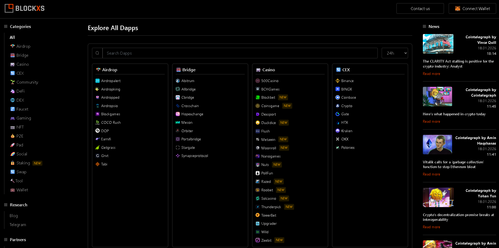

Notably, the best Matrix platforms in 2026 are built for real-time data, multi-panel dashboards, and quick execution across popular chains. Specifically, they help you spot opportunities earlier, reduce emotional trading, and manage risk with alerts and automation. Moreover, more users now demand truly decentralized options where possible, so they can keep control of funds and avoid over-sharing data. That is why privacy-first setups, non-custodial connections, and transparent analytics are becoming standard expectations.

Consequently, Matrix platforms are no longer “nice to have.” They are turning into the daily workbench for anyone who wants to trade, track, or research efficiently. Additionally, these tools can help beginners by simplifying complex charts into clear actions, while advanced users get deep filters, token scanners, and execution features. Therefore, here are the 7 best Matrix crypto platforms currently leading the industry.

Top Matrix Crypto Platforms

1. Matrixport – All-in-One Crypto Yield and Trading Hub

Matrixport tops our list as the most complete Matrix Crypto Platforms for users who want trading, earning, and structured products in one dashboard. Furthermore, this feature-rich platform operates with a strong focus on user experience, making advanced tools feel simple. Notably, Matrixport excels in offering flexible options for earning yield while still keeping fast access to markets.

What sets Matrixport apart is its product breadth under one roof. Specifically, you can explore yield solutions, structured products, and market tools without bouncing across multiple sites. Additionally, the interface keeps core actions clear, which helps newer users avoid mistakes. Moreover, its ecosystem approach makes it easier to plan strategies instead of reacting to charts all day. Consequently, with streamlined portfolio tools and multiple earning paths, Matrixport delivers a practical “control center” for active crypto users.

2. TradingView – The Matrix Dashboard for Charting and Signals

TradingView tops our list as the most popular visual command center for technical analysis. Furthermore, this powerful platform operates with real-time charting, custom indicators, and multi-chart layouts that feel like a true Matrix screen. Notably, TradingView excels in helping you compare many assets quickly and spot trends before they become obvious.

What sets TradingView apart is its massive indicator and strategy ecosystem. Specifically, you can use community scripts or build your own alerts and backtests. Additionally, multi-timeframe layouts make it easier to confirm entries instead of guessing. Moreover, cloud-based workspaces let you switch devices without losing setups. Consequently, with alerts, layouts, and deep chart tools, TradingView delivers a fast, readable way to manage market decisions.

3. DEX Screener – Live On-Chain Charts for Token Hunters

DEX Screener tops our list as the easiest on-chain Matrix tool for tracking new tokens and fast-moving pairs. Furthermore, this real-time platform operates by pulling decentralized exchange data across multiple networks. Notably, DEX Screener excels in showing price action, liquidity, and volume in a way that helps you judge if a token is active or fading.

What sets DEX Screener apart is its speed and simplicity for on-chain discovery. Specifically, you can scan trending pairs, filter by chain, and jump straight into detailed charts. Additionally, quick access to liquidity and transaction activity helps you avoid dead or risky markets. Moreover, it supports many ecosystems, so you can monitor opportunities without opening ten tabs. Consequently, with clean charts and rapid pair discovery, DEX Screener delivers strong value for active DeFi users.

4. DEXTools – Advanced DeFi Analytics With Safety Context

DEXTools tops our list as the most feature-packed Matrix toolkit for DeFi traders who want deeper analytics. Furthermore, this analytics platform operates with token dashboards that highlight trading activity and important contract details. Notably, DEXTools excels in combining charting with extra context, which is useful when markets are full of low-quality launches.

What sets DEXTools apart is its detailed token pages and discovery features. Specifically, it offers trending lists and monitoring tools that help you find activity spikes early. Additionally, its data presentation helps you evaluate liquidity and momentum with fewer clicks. Moreover, you can use it to compare tokens across ecosystems while keeping your workflow consistent. Consequently, with rich analytics and streamlined discovery, DEXTools delivers a strong Matrix-style view for DeFi decision-making.

5. Nansen – Smart Money Tracking for Clean Decisions

Nansen tops our list as the best Matrix platform for users who want to understand what wallets are doing on-chain. Furthermore, this analytics platform operates by labeling addresses and surfacing behavior patterns in a clear way. Notably, Nansen excels in showing where capital is moving, which can help you avoid trading blind.

What sets Nansen apart is its wallet intelligence and flows analysis. Specifically, you can track smart money moves, exchange flows, and token holder behavior. Additionally, dashboards make it easier to connect news with real on-chain actions. Moreover, the data helps you validate hype or spot weakening demand early. Consequently, with high-signal on-chain insights, Nansen delivers a more confident way to plan trades and investments.

6. Zapper – DeFi Portfolio Control Center

Zapper tops our list as the most beginner-friendly Matrix dashboard for tracking DeFi positions. Furthermore, this portfolio platform operates by connecting to wallets, then showing balances and positions in a clean summary. Notably, Zapper excels in making multi-protocol DeFi easier to understand without digging through each dApp.

What sets Zapper apart is its simple view of complex holdings. Specifically, you can see tokens, LP positions, and DeFi exposure in one interface. Additionally, it reduces the stress of missing positions across chains or apps. Moreover, it helps you manage your time by centralizing monitoring instead of constant manual checking. Consequently, with a clear portfolio snapshot and smooth navigation, Zapper delivers a strong daily driver for DeFi users.

7. Zerion – Non-Custodial Wallet + Portfolio Matrix

Zerion tops our list as the most polished non-custodial Matrix experience for wallet-based users. Furthermore, this portfolio-first platform operates by keeping you in control of your funds while still offering deep tracking. Notably, Zerion excels in presenting your on-chain activity in a simple, readable way that works for beginners and active users alike.

What sets Zerion apart is its smooth blend of wallet access and analytics. Specifically, you can monitor tokens, NFTs, and DeFi positions with a clean interface. Additionally, non-custodial design supports a truly decentralized mindset because you are not handing over custody to a third party. Moreover, the app-style experience makes daily tracking easy on both desktop and mobile. Consequently, with self-custody and clear portfolio views, Zerion delivers a reliable Matrix hub for modern crypto.

Matrix Crypto Platforms

The best Matrix crypto platforms share clear dashboards, real-time data, and tools that reduce guesswork. Additionally, they help users move faster while staying organized, whether the focus is trading, DeFi, or on-chain research. Notably, this category represents the future because crypto keeps expanding across chains and apps, and people want truly decentralized control with smarter decision support. Therefore, as blockchain tools mature, Matrix platforms will become even more essential for daily crypto life.

Comparison Table

| Platform | Best For | Main Strength |

|---|---|---|

| Matrixport | Trading + earning in one place | All-in-one product suite and usability |

| TradingView | Charting and alerts | Multi-layout technical analysis |

| DEX Screener | Finding trending on-chain pairs | Fast multi-chain pair discovery |

| DEXTools | DeFi analytics with extra context | Deep token dashboards and discovery tools |

| Nansen | Wallet tracking and flows | Smart money and on-chain behavior insights |

| Zapper | DeFi portfolio tracking | Simple view of multi-protocol positions |

| Zerion | Non-custodial portfolio management | Self-custody with polished tracking |

Note: “Best For” describes the most common use case, while “Main Strength” highlights the key advantage that makes each platform feel like a Matrix-style control center.