Top 7 Best Balancer Alternatives of 2026

Why Balancer DeFi Still Wins in 2026

Balancer made a big idea popular: on-chain pools that can hold multiple assets, rebalance weights, and route trades with smart pricing. This category matters because it gives regular users tools that used to be reserved for pros, like diversified liquidity pools, flexible fee settings, and automated portfolio behavior. Additionally, it supports traders who want better execution and LPs who want more control over risk and yield.

What makes this space exciting is how close it stays to truly decentralized finance. You can swap, provide liquidity, and sometimes even manage pool rules directly from non-custodial wallets. Notably, many of today’s Balancer-style platforms also support cross-chain access, smarter routing, and lower fees through L2 networks, which makes on-chain trading feel fast and simple.

These platforms are also important for builders. Specifically, other DeFi apps can plug into deep liquidity, reliable pricing, and permissionless pool creation to create new strategies and products. Moreover, competition has pushed features forward, like boosted pools, concentrated liquidity, stable swap curves, and aggregator-grade routing.

Consequently, if you like what Balancer offers but want different fees, chains, pool designs, or better routing, you have strong options. Therefore, here are the 7 best Balancer alternatives currently leading the industry.

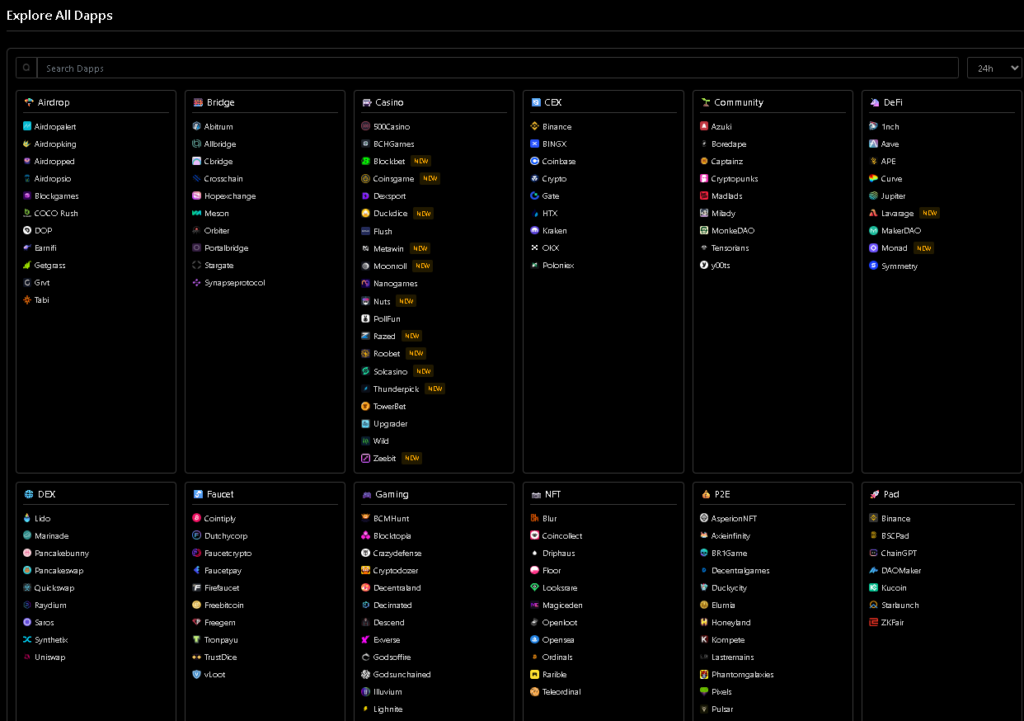

Top Picks for Balancer Alternatives

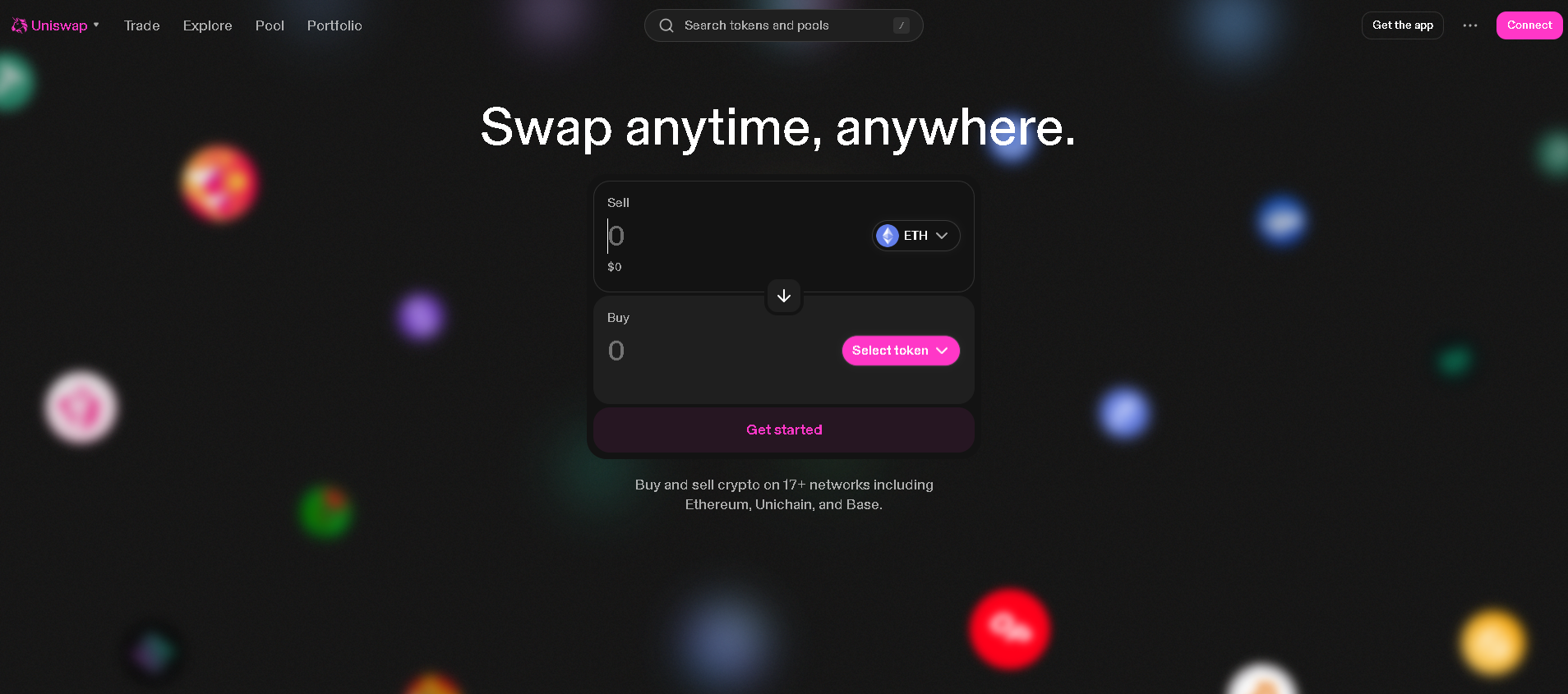

1. Uniswap – The Blue-Chip DEX for Efficient Swaps

Uniswap tops our list as the most recognized decentralized exchange for simple, efficient token swaps. Furthermore, this widely used platform operates across multiple networks, helping users avoid high fees when Ethereum is busy. Notably, Uniswap excels in deep liquidity for popular pairs and consistent execution for everyday trading.

What sets Uniswap apart is its concentrated liquidity design. Specifically, liquidity providers can choose price ranges to target higher fee potential. Additionally, its interface stays beginner-friendly even when using advanced pools. Moreover, the ecosystem support is huge, which helps token availability and integrations. Consequently, with strong liquidity and broad chain support, Uniswap delivers reliable DeFi swapping at scale.

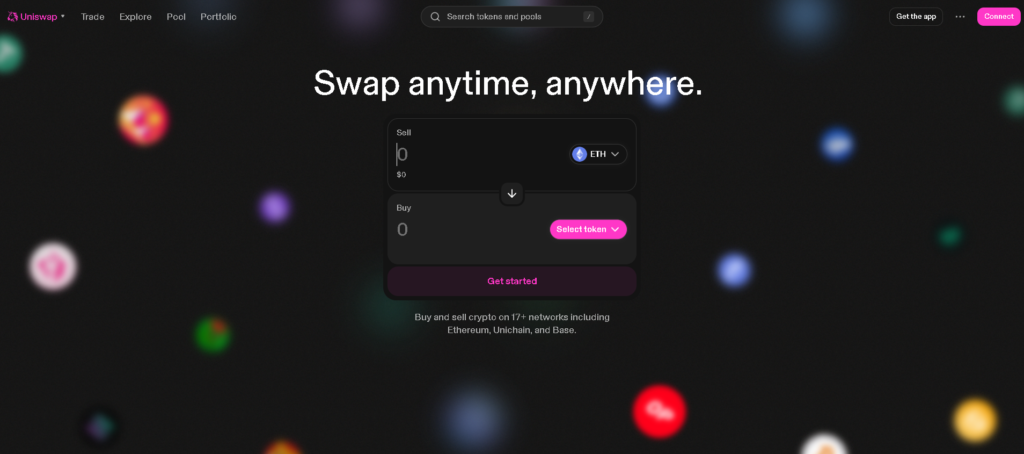

2. Curve – The Stablecoin and LST Swap Specialist

Curve tops our list as the go-to choice for low-slippage stablecoin trading. Furthermore, this specialized platform operates with bonding curves that are designed to keep stable assets trading close to their peg. Notably, Curve excels in capital-efficient pools for stablecoins and liquid staking tokens where small price differences matter.

What sets Curve apart is its focus on minimal slippage and strong LP incentives. Specifically, many pools are optimized for stable-to-stable swaps. Additionally, governance and incentives often attract deep liquidity over time. Moreover, Curve is commonly used by aggregators for best-price routing. Consequently, with efficient stable swaps and strong depth, Curve delivers smoother execution for stable asset traders.

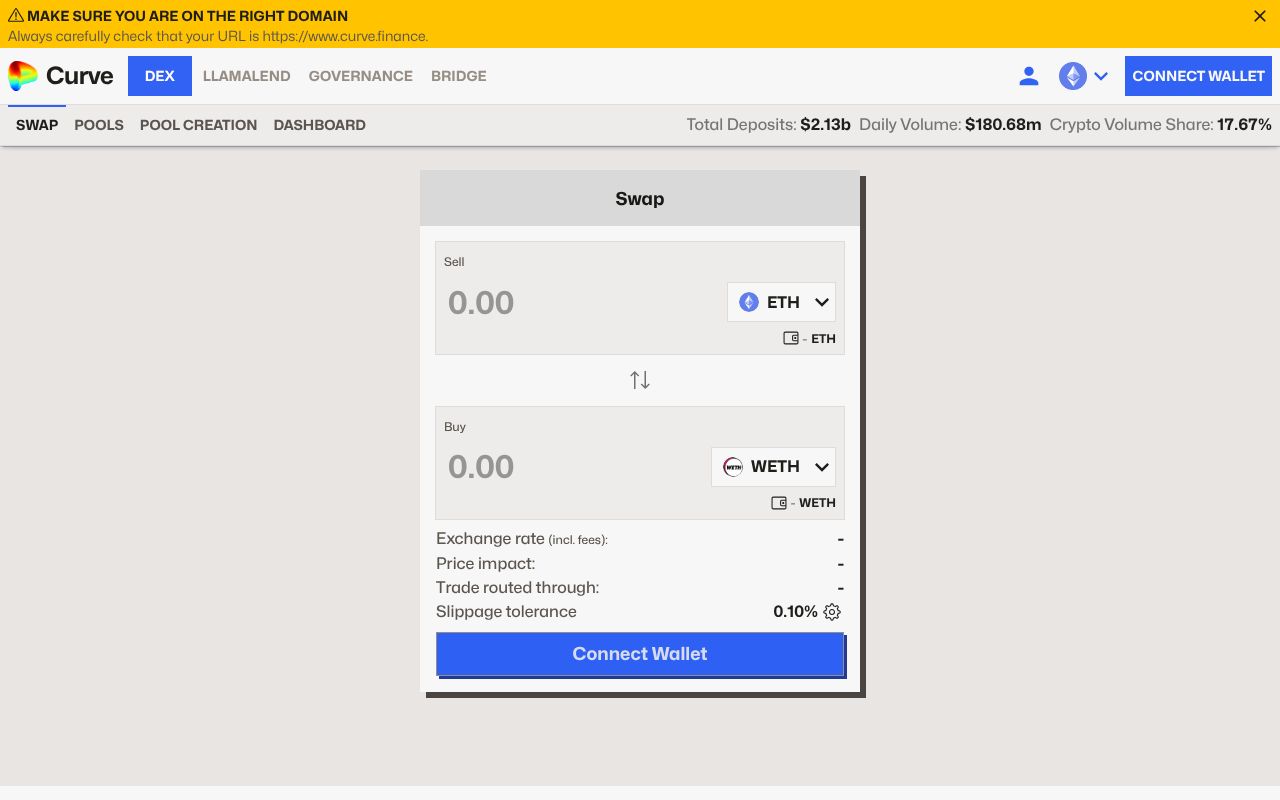

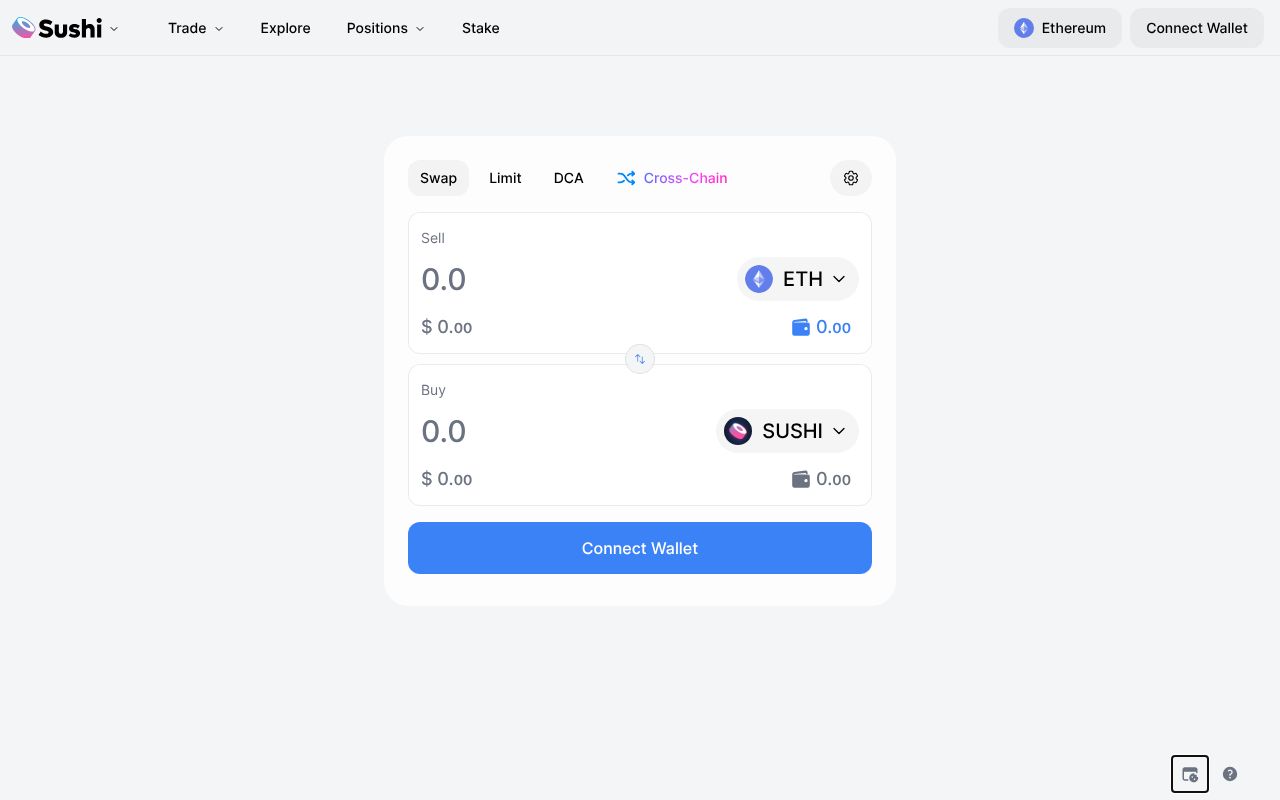

3. SushiSwap – Multi-Chain Liquidity With Extra Tools

SushiSwap tops our list as a flexible DEX option that goes beyond basic swapping. Furthermore, this multi-chain platform operates across several ecosystems, which can help users find cheaper gas and more token choices. Notably, SushiSwap excels in offering extra DeFi tools depending on the network, including yield features and community-driven expansions.

What sets SushiSwap apart is its broad approach to DeFi utility. Specifically, it supports a wide range of chains and tokens. Additionally, the project has historically focused on adding features that keep users inside one hub. Moreover, it can be a practical option for exploring smaller ecosystems. Consequently, with multi-chain access and extra functionality, SushiSwap delivers an all-in-one DEX experience.

4. PancakeSwap – Low-Fee Trading for Everyday Users

PancakeSwap tops our list as the easiest entry point for users who care about low fees and fast transactions. Furthermore, this popular platform operates with a strong presence on BNB Chain and expands across other networks as well. Notably, PancakeSwap excels in simple swaps, quick confirmations, and a smooth interface that feels beginner-proof.

What sets PancakeSwap apart is its mix of DEX trading and gamified features. Specifically, it often offers accessible liquidity pools and yield options. Additionally, the platform tends to list a broad set of tokens from its core ecosystem. Moreover, its speed makes frequent small trades more practical. Consequently, with low costs and simple UX, PancakeSwap delivers convenient DeFi for daily use.

5. KyberSwap – Smart Routing for Better Prices

KyberSwap tops our list as a strong choice for users who want better execution through routing. Furthermore, this aggregator-style platform operates by scanning liquidity sources to find competitive rates. Notably, KyberSwap excels in reducing wasted value from poor pricing by splitting trades or routing across pools when needed.

What sets KyberSwap apart is its emphasis on efficiency and flexibility. Specifically, it can help users avoid bad slippage on larger swaps. Additionally, it supports multi-chain access, which can cut costs. Moreover, it often integrates liquidity sources that normal users would not manually check. Consequently, with smarter routing and broad liquidity access, KyberSwap delivers improved swap outcomes.

6. Bancor – Liquidity Options Built Around LP Protection Ideas

Bancor tops our list as a notable alternative focused on different LP mechanics than standard AMMs. Furthermore, this DeFi platform operates with models that have historically aimed to reduce the pain of impermanent loss for liquidity providers. Notably, Bancor excels in offering an alternative way to think about providing liquidity, especially for users who want a more guided LP experience.

What sets Bancor apart is its distinct pool design and protocol-focused liquidity approach. Specifically, it has experimented with protection mechanisms and protocol-managed liquidity concepts. Additionally, it can appeal to LPs who want a different risk profile than typical AMMs. Moreover, it offers an established DeFi brand with a long track record. Consequently, with alternative LP mechanics and protocol-driven design, Bancor delivers a different style of liquidity providing.

7. 1inch – Aggregator Power With Advanced Trade Controls

1inch tops our list as the best option for users who want aggregator-grade pricing with extra controls. Furthermore, this platform operates by sourcing liquidity across many DEXs to find a competitive route. Notably, 1inch excels in features that active traders value, including route optimization and settings that can help manage slippage behavior.

What sets 1inch apart is its combination of pricing tech and user controls. Specifically, it can split orders across venues to reduce price impact. Additionally, its interface often includes advanced options without feeling too complex. Moreover, it supports multiple chains, which helps users pick lower-fee environments. Consequently, with optimized execution and strong tooling, 1inch delivers powerful DeFi swapping for careful traders.

The Balancer Alternatives Advantage

These platforms share clear benefits: non-custodial access, transparent on-chain pricing, and liquidity that anyone can help build. Additionally, they push DeFi toward simpler, cheaper, and more open markets that work 24/7. Consequently, this category represents the future of trading and portfolio tools as blockchain becomes faster and more modular. Therefore, expect even more smart routing, better pools, and deeper cross-chain liquidity as the next wave evolves.

Comparison Table

| Platform | Best For | Typical Strength |

|---|---|---|

| Uniswap | General token swaps | Deep liquidity and efficient execution |

| Curve | Stablecoins and LSTs | Low slippage on correlated assets |

| SushiSwap | Multi-chain DeFi usage | Wide chain coverage and extra tools |

| PancakeSwap | Low-fee everyday trading | Fast swaps and beginner-friendly UX |

| KyberSwap | Best-price routing | Aggregator routing to reduce slippage |

| Bancor | Alternative LP mechanics | Different pool models and LP design |

| 1inch | Advanced swaps and controls | Order splitting and route optimization |

Note: “Best For” and “Typical Strength” are practical, user-focused metrics based on common DeFi usage patterns, including liquidity depth, routing efficiency, and the type of assets each platform is known to handle well.