Top 7 Best Uniswap Alternatives of 2026

Swap Smarter in 2026

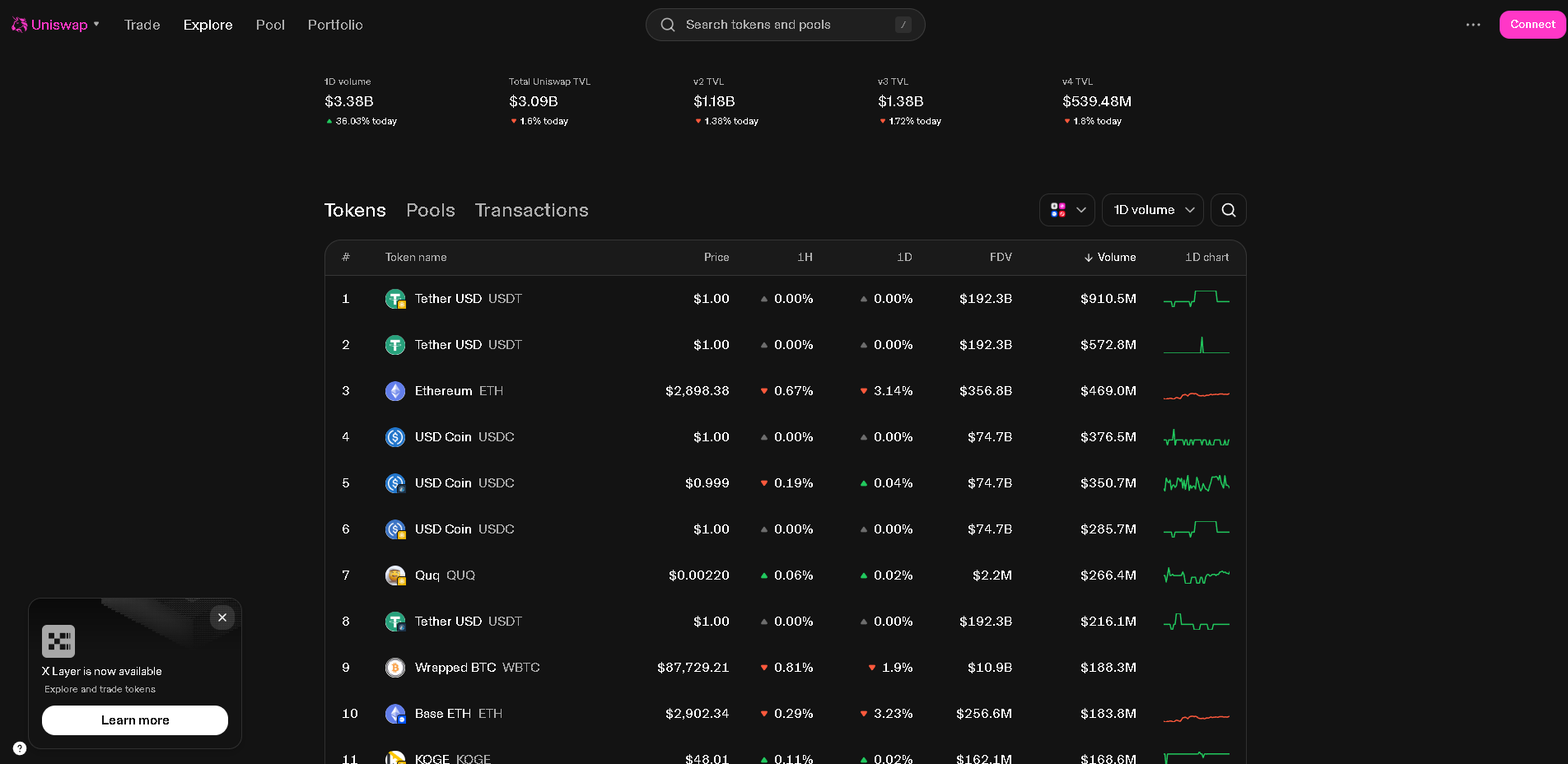

Uniswap helped make crypto trading simple by letting anyone swap tokens without a traditional broker. That idea is still very exciting today because decentralized exchanges let users trade straight from their own wallets. Additionally, these platforms often support new tokens faster than centralized exchanges, and they can be used globally without account approvals.

If you like Uniswap but want more chains, better routes, or extra features, having strong alternatives is useful. Therefore, here are the 7 best Uniswap alternatives currently leading the industry.

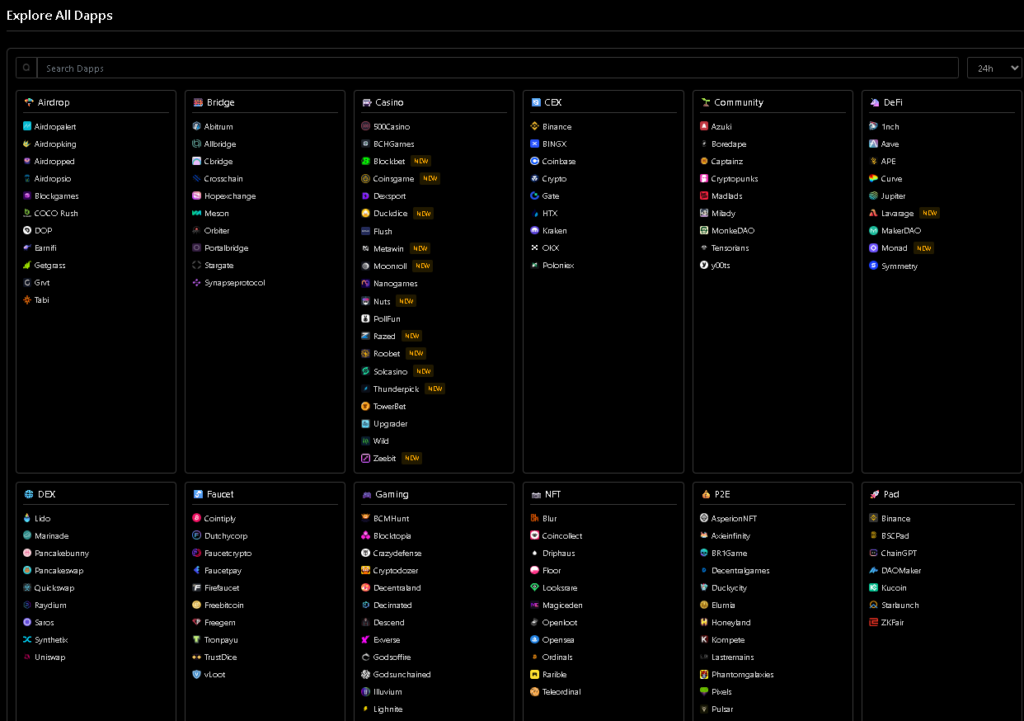

Top Uniswap Alternatives to Use

1. 1inch – Best for Finding the Lowest Swap Price

1inch – Best for Finding the Lowest Swap Price

1inch tops our list as the best choice for price optimization across multiple DEX pools. Furthermore, this aggregator platform operates by routing your trade through the most efficient liquidity sources. Notably, 1inch excels in reducing slippage and improving execution on larger or more complex swaps.

What sets 1inch apart is its smart routing engine. Specifically, it can split one trade across multiple pools to lower total cost. Additionally, it offers limit orders on supported networks, which helps you avoid chasing price moves. Moreover, wallet and dApp integrations are widely available. Consequently, with better routing and flexible trade tools, 1inch delivers consistently strong swap outcomes.

2. PancakeSwap – Best for Low Fees and BNB Chain Trading

PancakeSwap tops our list as the strongest Uniswap-style option for users who want cheap swaps and fast confirmations. Furthermore, this high-activity platform operates primarily on BNB Chain with a deep token ecosystem. Notably, PancakeSwap excels in accessibility, since many users find its costs and speed easier than Ethereum mainnet trading.

What sets PancakeSwap apart is its all-in-one DeFi feature set. Specifically, it supports swaps, liquidity pools, and earning options in one interface. Additionally, it frequently adds new community tokens and popular pairs quickly. Moreover, it also supports multiple chains, which expands your choices. Consequently, with low fees and strong liquidity, PancakeSwap delivers a simple DEX experience for everyday traders.

3. SushiSwap – Best Multi-Chain DEX for Versatile DeFi Users

SushiSwap tops our list as a flexible option for users who want a familiar AMM with broad network coverage. Furthermore, this multi-chain platform operates across several Ethereum-compatible ecosystems, giving users more places to trade. Notably, SushiSwap excels in serving long-time DeFi users who want a simple swap experience plus extra tools.

What sets SushiSwap apart is its continued focus on cross-chain presence and community-driven DeFi. Specifically, it offers swaps and liquidity options across multiple networks. Additionally, it often provides opportunities for users who want to explore different ecosystems without changing platforms. Moreover, it keeps a clean interface that feels similar to other leading AMMs. Consequently, with multi-chain access and solid liquidity, SushiSwap delivers a dependable Uniswap alternative.

4. Curve Finance – Best for Stablecoin Swaps and Low Slippage

Curve Finance tops our list as the best choice for traders swapping stablecoins or similar-priced assets. Furthermore, this specialized platform operates with pool designs optimized for low price impact. Notably, Curve excels in minimizing slippage on large stablecoin swaps, which is a major advantage for serious users.

What sets Curve apart is its focus on efficient stable-asset liquidity. Specifically, it is designed to keep trades close to the expected peg price. Additionally, it frequently supports major stablecoin pools and liquid wrapped asset pairs. Moreover, it is widely used in DeFi strategies where stable swaps matter most. Consequently, with tighter pricing and efficient pools, Curve Finance delivers a strong swap solution when stability is the goal.

5. Balancer – Best for Custom Pools and Smart Liquidity

Balancer tops our list as the most customizable alternative for users who want more than basic 50/50 pools. Furthermore, this advanced platform operates with flexible pool weights and automated rebalancing concepts. Notably, Balancer excels in giving liquidity providers and protocols more control over pool structure.

What sets Balancer apart is its pool design flexibility. Specifically, pools can hold multiple tokens and use different weighting approaches. Additionally, this can create trading routes that look different from classic AMMs and may improve certain executions. Moreover, it is often used by DeFi projects that need tailored liquidity solutions. Consequently, with customizable pools and strong DeFi adoption, Balancer delivers a powerful option beyond standard Uniswap-style swaps.

6. dYdX – Best for Advanced Traders Who Prefer Perps

dYdX tops our list as the best alternative for users who want trading tools beyond spot token swaps. Furthermore, this advanced platform operates with a focus on derivatives, especially perpetual contracts. Notably, dYdX excels in providing deeper order-style trading features that many AMM DEXs do not offer.

What sets dYdX apart is its trader-first interface and performance. Specifically, it is built for frequent, active trading rather than occasional swaps. Additionally, it supports features like leverage and more strategic position management. Moreover, it is often favored by users who want a DEX feel with more professional-grade tools. Consequently, with strong derivatives features and a smoother trading workflow, dYdX delivers a serious option for experienced users.

7. Jupiter – Best Aggregator for Solana Swaps

Jupiter tops our list as the top choice for users swapping tokens within the Solana ecosystem. Furthermore, this aggregator platform operates by scanning multiple Solana liquidity sources to find strong pricing. Notably, Jupiter excels in speed and cost efficiency because Solana transactions are typically fast and low-fee.

What sets Jupiter apart is its focus on best-route execution for Solana users. Specifically, it aims to reduce price impact by choosing optimized paths. Additionally, it is widely integrated into Solana wallets and DeFi apps, making it easy to access. Moreover, it supports a broad range of Solana tokens and pairs. Consequently, with fast execution and competitive routing, Jupiter delivers a strong Uniswap-style experience on a different chain.

The Uniswap Alternative Advantage

The best Uniswap alternatives share clear benefits like self-custody trading, quick token access, and competitive pricing across networks. Additionally, they show why decentralized finance is becoming the default choice for many users who want more control. Notably, as chains scale and routing improves, DEX experiences keep getting simpler and cheaper. Therefore, these platforms are positioned to grow alongside the next wave of blockchain evolution.

Comparison Table

| Platform | Best For | Typical Fee Angle |

|---|---|---|

| 1inch | Best-price routing across DEXs | Gas + underlying pool fees, optimized routes may reduce total cost |

| PancakeSwap | Cheap swaps on BNB Chain | Low network fees, AMM pool fees vary by pair |

| SushiSwap | Multi-chain swaps and pools | Depends on chain + pool fee tier |

| Curve Finance | Stablecoin and pegged-asset swapping | Often very low slippage for stable pairs; fees vary by pool |

| Balancer | Custom pools and advanced liquidity | Pool fees depend on configuration and chain gas |

| dYdX | Perpetuals and active trading tools | Trading fees depend on volume tier; not a simple AMM swap fee model |

| Jupiter | Best routing for Solana swaps | Very low network fees on Solana + underlying pool fees |

Note: “Typical Fee Angle” reflects common cost drivers like network gas, pool fee tiers, and routing. Exact fees change by chain conditions, token pair, and trade size.